Home/ Expand Your Impact / Mission Aligned Investors Hub

What is Mission Aligned Investing (MAI)?

Quite simply, it means aligning your assets with your values and mission by investing in things that generate positive social and environmental impact alongside a financial return.

Our 3-Minute Film Offers a Fast Introduction to MAI

Our MAI Endowment Starter Kit Provides The Basics You Need

You’ve been told to grow, grow, grow your endowment. However, if you’re investing in businesses that actively oppose your mission, it’s time to rethink your investments. Make your dollars make sense.

[1] Define your mission and values.

[2] Examine what your investments fund.

[3] Identify which investments don’t align.

[4] Find new investments that align with your mission.

[5] Let your money grow and do great things!

Dive Deeper With Additional Resources

Elizabeth with Ruth Shaber, MD, and Patience Marime-Ball, esq., co-authors of The XX Edge: Unlocking Higher Returns and Lower Risk.

Meet Fellow Paradigm Shifters

It’s time to shift the paradigm. Someone has to pave the way! Explore stories of leaders using endowments, CDFIs, and other piles of money to create real change. These stories are taken from our Paradigm Shifters newsletter.

Elizabeth with Ruth Shaber, MD, and Patience Marime-Ball, esq., co-authors of The XX Edge: Unlocking Higher Returns and Lower Risk.

UnTours Foundation Impact

Mission Aligned

FAQs

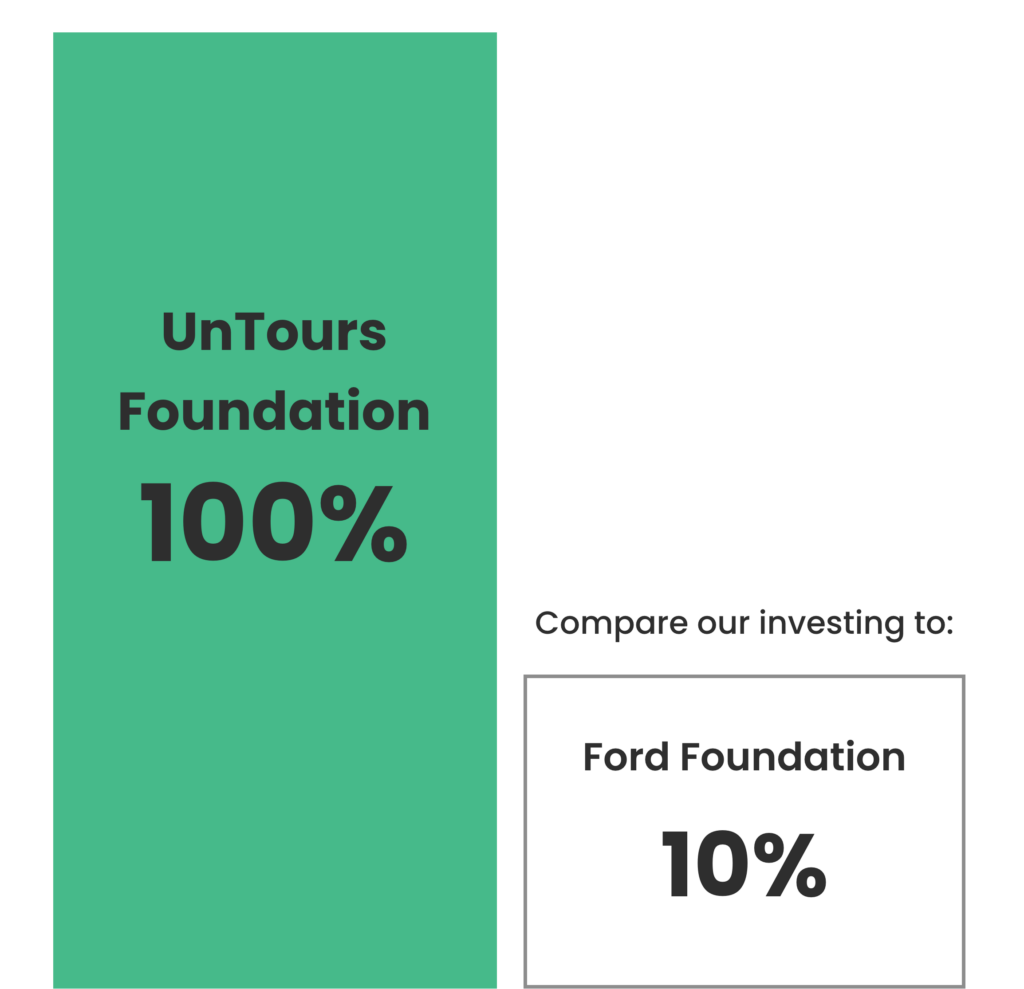

From our start in 1992! Our founder, Dr. Hal Taussig, Sr., had no idea this is what he set in motion. After all, there was no term or understanding of mission aligned investing then. What Hal knew is that it made no sense to him to invest in things he didn’t agree with only to give the earnings from those investments to things he did believe in. So from the get-go, he used our endowment as a revolving loan fund. This was considered so far out-of-the-box, that we were denied membership in our local foundation umbrella organization for a time. Now that organization is a champion of MAI – and we are members!

Absolutely! We are here as a resource for you. We’re elated when organizations reach out. Together we will shift the paradigm.

Contact Elizabeth at [email protected] with questions and conversation. Our team can answer your questions, guide you on your journey, present to your staff and board on the benefits of mission aligned investing, match-make you with a foundation that is further along on the MAI journey, and more!

Studies show that returns on MAI are equal or superior to traditional investing. The XX Edge: Unlocking Higher Returns and Lower Risk by Patience Marime-Ball, Esq. & Ruth Shaber, MD, demonstrates how businesses run by teams with diversity of gender and race are more profitable.

Consider as well that if your endowment is invested without a mission lens, your investments are probably working against your very mission. So with 5% of your assets working for your mission through grants and overhead, and up to 95% working against your mission – you do the math!

Expand Your Knowledge

A decade ago, I met a fellow foundation director, Laura Kind McKenna, who said to me: “Because the UnTours Foundation...Read More

June 7, 2023 by Rich Hoffmann of 215 Timelapse, the creator of our new MAI short film, Dollars That Make...Read More

The Untours Foundation’s longtime director Elizabeth Killough recently sat down with Technical.ly Assistant Editor Stephen Babcock to talk about impact...Read More

Our director, Elizabeth, was invited to write a piece about impact investing and risk, a specialty of the Untours Foundation...Read More

Huff Post blog by Untours Foundation Director Elizabeth Killough There’s a lot of judgment these days about your endowment. You...Read More