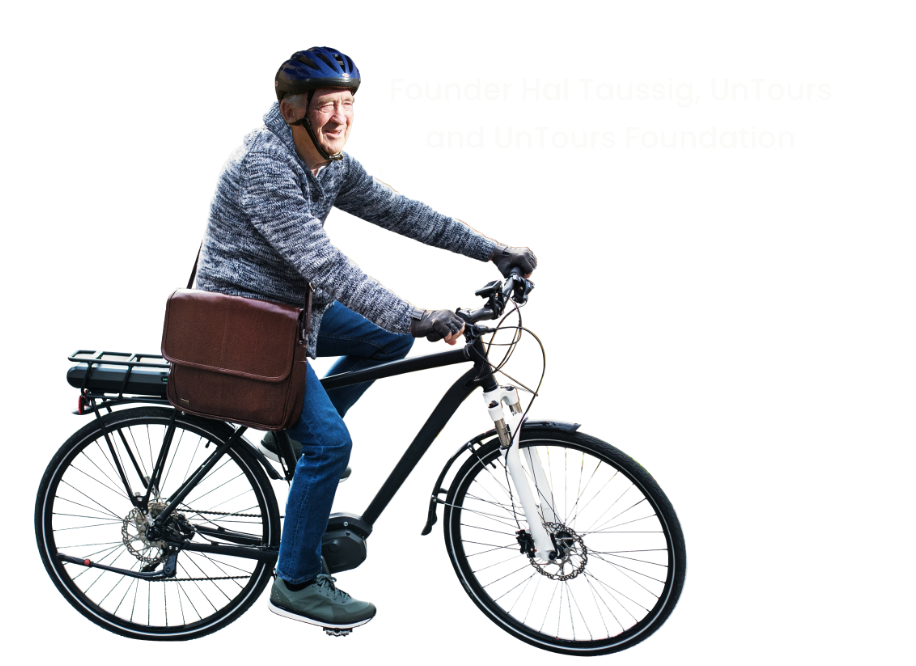

A decade ago, I met a fellow foundation director, Laura Kind McKenna, who said to me: “Because the UnTours Foundation endowment is 100% mission aligned, you should evangelize about that.” I didn’t have a clue what she was talking about! I told her that we didn’t have an endowment, only a Loan Fund to which she said, “That is your endowment, Silly, now get to work!” And so the journey began!

Starting with the basics, mission aligned investing (MAI) is simply the process of aligning your assets with your values by investing in things that generate positive social and environmental benefits along with a financial return. This can apply to your savings account, your retirement fund, the endowment at your alma mater or house of worship, or any pile of money that’s not under your mattress.

So, yes, we didn’t know – and our beloved founder, Hal, didn’t know – that he/we practiced mission aligned investing. For our first two decades, most people thought Hal was crazy to use our full endowment as a revolving loan fund to invest directly in world-enhancing businesses that address major problems. On the other hand, Hal thought it would be crazy to invest in businesses on Wall Street that he didn’t believe in, only to make a little money to give to businesses he did believe in. His style of investing was considered so preposterous at the time that we were actually denied membership in our local umbrella organization for foundations.

But things have come full circle, and now Hal and the foundation are viewed as leaders in this MAI movement. Thanks to what Hal put in motion, we can claim that for all our 30 years, our endowment has been 100% mission aligned. Keep in mind that the Ford Foundation’s endowment is only up to 10%! We also don’t know of another foundation that can match our track record. And, yes, we are now members of our local umbrella organization for foundations.

What do we do about MAI?

Thanks to funders like Laura McKenna, Halloran Philanthropies, Tara Health Foundation, and more, we guide other foundations in how to move their endowments into investments that work for their missions. We host webinars, produce written materials, write blogs, the whole nine yards. We made this fun and cool 3-minute video that we’ve entered in film festivals! Check out the cat host!

As our film shows, foundations are required by the IRS to distribute at least 5% of their assets annually to fulfill their mission. Most do just that: the 5% minimum. This funding typically goes to grants and overhead. And the other 95% is invested without thought to mission, often actually working against the mission. Nonprofit raters like Candid (aka GuideStar) and Charity Navigator rate ONLY on the 5%. An environmental organization can get the highest rating on both sites and have all of its endowment in coal and oil. We’ve lobbied both rating sites, including meeting with both CEO’ encouraging them to add endowments to their ratings.

What can you do?

- Align your money with your values. Use the easy tool at As You Sow to look up some of your personal holdings to see what’s really in them. Put your asset manager to work finding things that fulfill your values.

- Vote your proxies. Most shareholder resolutions on proxies are about the environment and officer compensation. Vote!

- Donate to nonprofits that let you see their holdings. Do you want to give to a nonprofit addressing lung cancer that’s invested in tobacco and air-polluting industries? For-profits must show their holdings to the public, so why not nonprofits?

How to check nonprofits’ holdings:

Go to GuideStar (aka Candid), where you can register for free. Look up any nonprofit, and on its home page click “Tax Forms.” Do they have an endowment – as do GreenPeace, the Red Cross, and most nonprofits with names you know? You can normally see endowment values in Part X, lines 11 through 13 of their 990 tax form. Do they list their holdings? If they do, the holdings are typically on the last few pages of the 990. If they don’t list their holdings, ask them where they invest their money! Ironically, GuideStar offers “Seals of Transparency” as its rating system though it never requires endowment transparency. It rates only on operating budgets, which are often just a tiny portion of a nonprofit’s assets. We are lobbying GuideStar to change that.

Where’s the UnTours Foundation’s endowment invested?

Dive into our portfolio right from our home page.

Learn More about what we are doing in the MAI field and meet more advocates at our MAI resource space.