🍂 Autumn greetings,

Our Endowment Starter Kit is hot off the press!

Check it out! It contains lots of basics plus resources, including a loan template for when you are ready to make direct investments outside of the traditional stock and bond markets. Please use our Kit, put it on your website, and share it liberally.

Let me know how I can help you move your endowment!

With gratitude,

Elizabeth

Meet an Endowment Champion

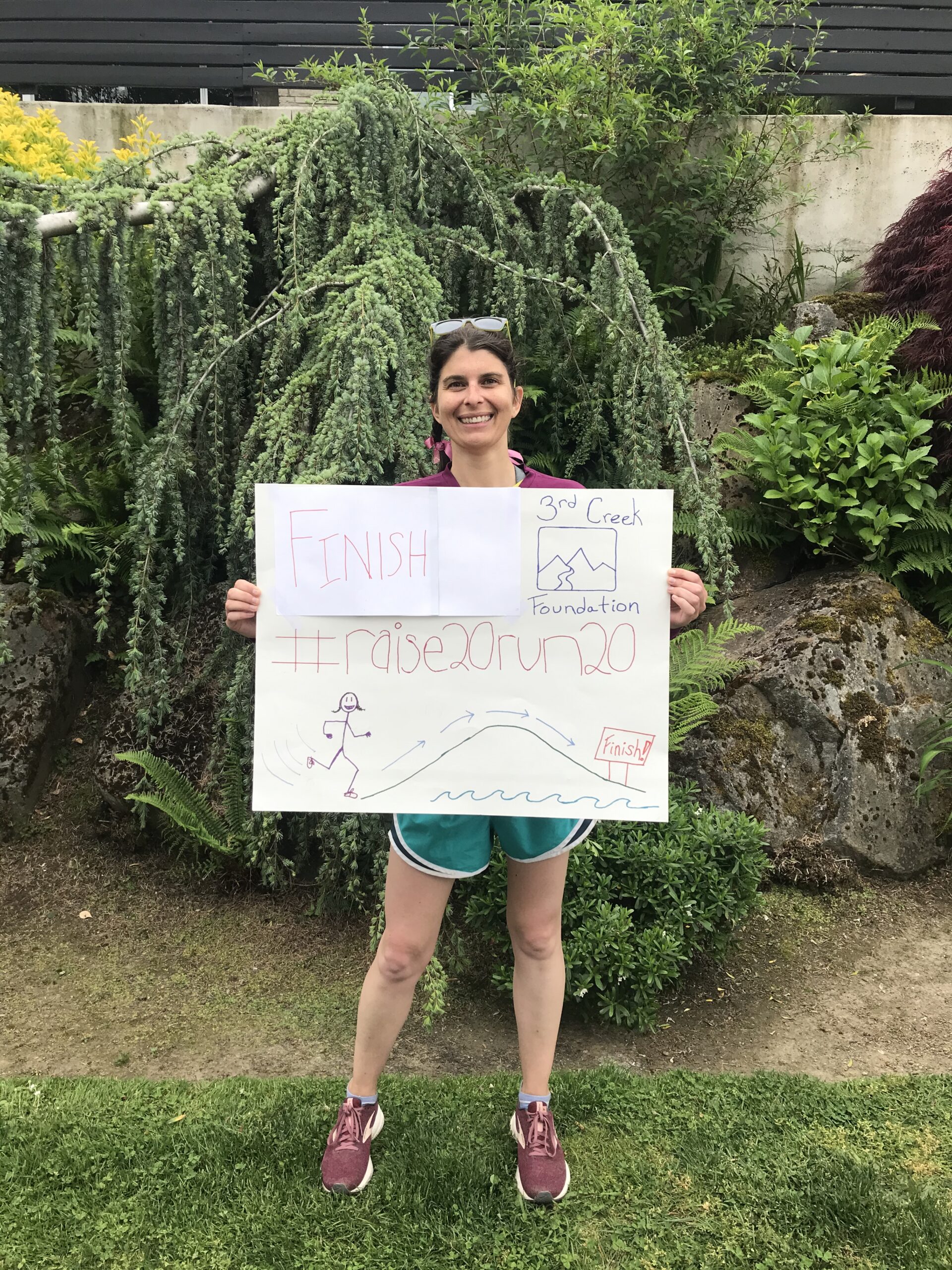

Gwen Straley

Executive Director, 3rd Creek Foundation

(And she’s also a Certified Financial Planner with 3rd Creek Investments, Inc., but below she is wearing mostly her Foundation hat.)

At Work…

What finally inspired you to start aligning your endowment with your mission? It was relatively easy to start making Program Related Investments (PRIs). We had been funding non-profit organizations supporting entrepreneurs, job creation, and income and savings improvement among some of the lowest income demographics in the world. We naturally came across small enterprises in the same environments whose business models aimed to achieve the same results, but in this case, they needed affordable loan capital. It was an easy decision to get started both from an impact and financial motivation.

What have been the biggest obstacles at your foundation for mission alignment? 3rd Creek Foundation is approximately a $2M foundation. To be an accredited non-profit organization, we need $5M or more. This limits our ability to invest in several private impact fund opportunities, even when they offer small-sized and appropriate investment minimums. While there are ways to do this via DAFs, we’ve concluded that the administrative cost is too high.

How far along is your foundation in this journey? Mature, motivated, and continuously learning. I also work as Director of Impact Investing and Philanthropy at 3rd Creek Investments, which helps keep us up to date with this ever evolving ecosystem.

What’s next in your mission alignment? We would love to expand our network of co-investors for small sized program related investments. In this way, we can catalyze more capital toward high impact initiatives without exceeding our own capacity. We enjoy co-investment partnerships with several small foundations and would like to continue building upon that.

What about perpetuity or spending/investing down? We are set up as a perpetual foundation, but often spend more than 5%. Our founders do not want to spend down, so when we see additional needs or crises among our partners, (e.g. the onset of the pandemic), we employ creative methods to fundraise for extra support. As an example, I ran a 20-mile fundraiser in 2020 to raise $20,000+. Almost all of that went out via our partner organizations as small cash grants (of $20-$50) to their beneficiaries who’d just lost their income with abrupt lockdowns. The remaining portion supported grantee partners with emergency operating funds as their other funders pulled back when the market took a steep downturn.

What’s a favorite mission aligned investment of yours? They are all favorites 😊 but I’ll share one that we’ve been working with now for 4 years: Imara Tech. This company has shown tremendous resilience and agility during times of fluctuation and has had to pivot its business model several times. It remains steadfast in its focus on creating efficiencies for smallholder farmers, and we’ve been honored to support them with accessible investment capital along the journey. The company is a Tanzanian, youth-led enterprise that empowers smallholder farmers with locally made, productive-use technologies that dramatically reduce time and labor for activities such as post-harvest threshing.

Have you ventured into shareholder advocacy? How so?! No, not yet. Since we are so focused on supporting the ultra poor with job creation and income improvement, we have focused our energies much more on program related investing to achieve the same objectives. We also have values aligned investments in the publicly traded portfolio, including impact bonds, but this isn’t where we place most of our focus and energy.

What’s the most convincing thing to get others on board? Sharing opportunities for Program Related Investments or impact investments that we’re reviewing/approving. You can spend a lot of time setting strategy and conceptualizing how to integrate mission aligned investing, but actually extending a low interest loan, for example, to a woman-led tailoring shop in Uganda, who is training and employing over a dozen previously unemployed women per year – that’s what gets it to really click for folks. (Reference: Mtindo, our most recent PRI partner). And having reputable co-investors also helps to bring others on board.

After Work…

Guilty pleasure: Ultra running and ice cream

Kickback film: Polite Society (relatively new, not really kickback)

Last series you binge-watched: Winning Time

Favorite caffeine source: Espresso

Sweet or salty: Both 😊

Happy place: Olympic Coast or Rainier backcountry

A favorite novel: I like nonfiction that reads like a novel. The Lemon Tree by Sandy Tolan and The Boys in the Boat by Daniel James Brown are two favorites that come to mind.

Animal friends: The regional river otters

Childhood ambition: Wildlife biologist

Biggest challenge: Climate change

Music that lifts your spirits: Jay-Z’s The Black Album

Most unusual gift given: baguette

Most unusual gift received: baguette candle

Last splurge: A house!

Invest With Us

Premiums for the Planet is providing a revolutionary solution to a massive, hidden-in-plain-sight problem: The insurance industry has been inadvertently fueling climate change. By investing heavily in fossil fuels and underwriting projects that harm the environment, insurers are contributing to the very catastrophes your business dollars are paying them to mitigate. This not only exacerbates climate-related risks but also drives up insurance premiums for businesses, creating a vicious cycle.

But by leveraging the power of collective action, PFP is transforming the insurance industry from a climate change enabler to a catalyst for positive change. Their platform aggregates the insurance buying power of climate-conscious companies, enabling PFP to negotiate for more sustainable investment practices and underwriting standards on their behalf. This not only reduces environmental impact but also provides companies with enhanced brand value and equal or better insurance coverage at competitive rates. Through their innovative model, they create a race to the top, incentivizing insurers to prioritize sustainability while delivering value to their customers. In essence, Premiums for the Planet is turning insurance into a force for good, driving systemic change and paving the way for a more sustainable future. And the best part? Unlike most sustainability initiatives, Premiums for the Planet doesn’t cost companies a dime beyond what they already spend on insurance.